(BIVN) – Ongoing federal cuts – and other policies – are raising the risk of an economic downturn in Hawaiʻi.

According to the University of Hawaiʻi Economic Research Organization’s (UHERO) first quarter forecast for 2025, the economic growth of Hawaiʻi is threatened by federal disruptions as a result of Trump administration policies and actions – including tariffs, mass deportations and spending cuts.

UHERO Focus: 2025 Q1 Forecast via YouTube

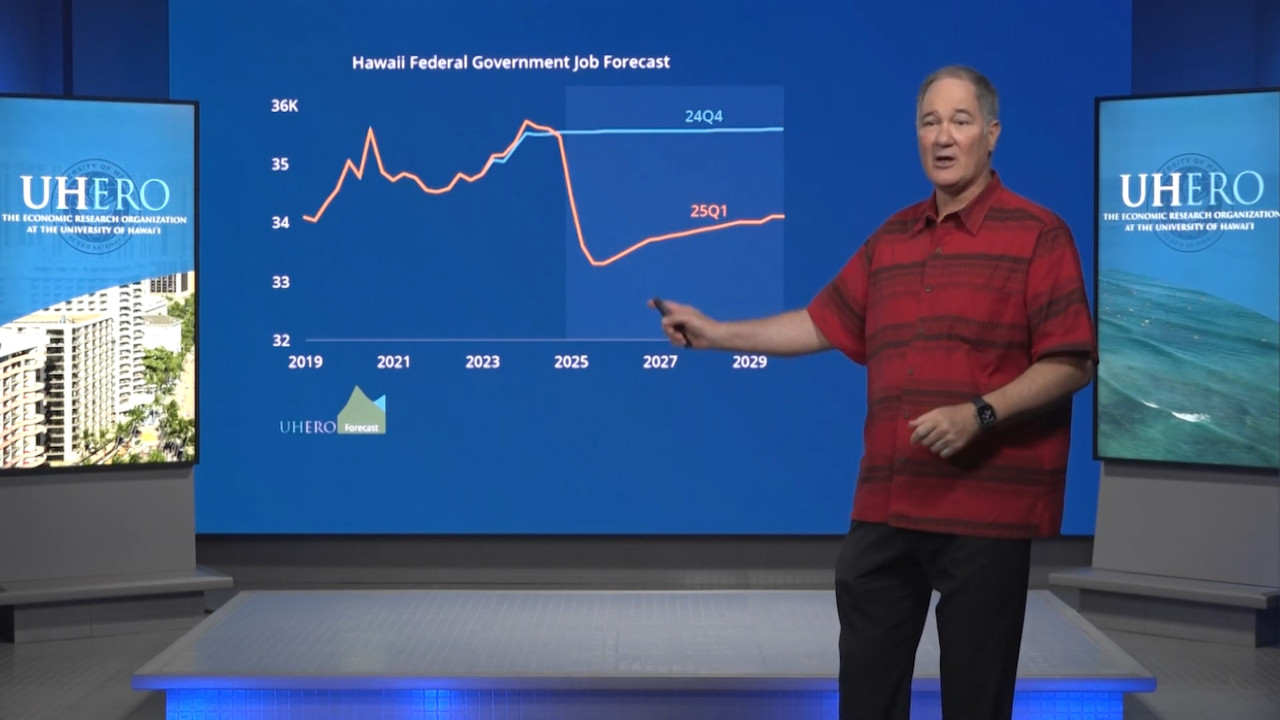

“The clearest near-term risk is federal layoffs, which could result in a loss of more than 2,000 local jobs, fully offsetting growth in construction and the lift from local tax cuts,” a University news release stated. “Together with other federal policies, this places the Hawaiʻi economy at risk of recession over the next few years.”

Key takeaways from the February 28 forecast:

- U.S. consumer spending continues to drive the U.S. economy, expanding at a buoyant 4.2% annualized pace in the final quarter of last year. Business investment has been weaker, and hiring has slowed. While substantial disinflation gains have been made, some components have moved up in recent months, suggesting an extended pause in further fed rate cuts.

- Large-scale federal layoffs are now underway, initially targeting probationary workers, mostly those hired less than a year ago. Another 75,000 federal workers have accepted so-called “deferred resignations.”

- Planned federal payroll cuts will include an estimated 2,200 Hawaiʻi-based workers, and cuts to federal contracts will likely increase overall local job losses. The administration’s temporary halt to all contracting—stalled for now by the courts—would be damaging to UH and many charitable agencies. Cuts to federal programs and grants could also impact state funding.

- The administration has imposed new tariffs, including an additional 10% levy on Chinese imports and a pending 25% tariff on steel and aluminum. Further tariff threats loom. Mass deportations, which apparently have yet to begin in earnest, would have disproportionate effects on agriculture and construction. Altogether, these policies, should they materialize, will raise business costs and consumer prices and slow the U.S. and global economies.

- Visitor numbers are stable, but not growing. Maui’s recovery from the wildfires remains slow. The U.S. market may benefit from federal tax cuts this year, but a weakening economy along with higher costs and prices will force a modest pullback in 2026–27.

- The Japanese market recovery will advance only very slowly. The recovery of other international markets will continue, although there is a risk that deteriorating global relations could hurt.

- Strong construction activity from both public and private sector projec ts, including Maui’s rebuilding, is driving employment toward a peak of nearly 41,000 construction workers in 2026. This remains the primary bright spot in the local economy. Tariffs on materials and potential labor shortages are looming concerns. There has been progress in efforts to build more affordable housing, although overall home building rates remain lower than in past decades.

“Overall economic growth in Hawaiʻi will feel the adverse effects of federal policies over the next several years, pulling job growth to zero and real GDP growth down to 1.6% this year,” the report said. “More extensive federal layoffs, tariffs or deportations could well result in a Hawaiʻi recession and undermine long-term growth prospects.”

by Big Island Video News6:56 am

on at

STORY SUMMARY

HONOLULU - Tariffs, mass deportations and spending cuts are likely to outweigh any stimulus provided by tax cuts under the new Trump administration, a new forecast reasons.