Livestream of Monday’s bill signing, courtesy ʻŌlelo Community Media

(BIVN) – State officials celebrated the signing of two major bills on Monday that will provide tax relief for Hawaiʻi residents, and exempt certain medical services from having to pay the General Excise Tax.

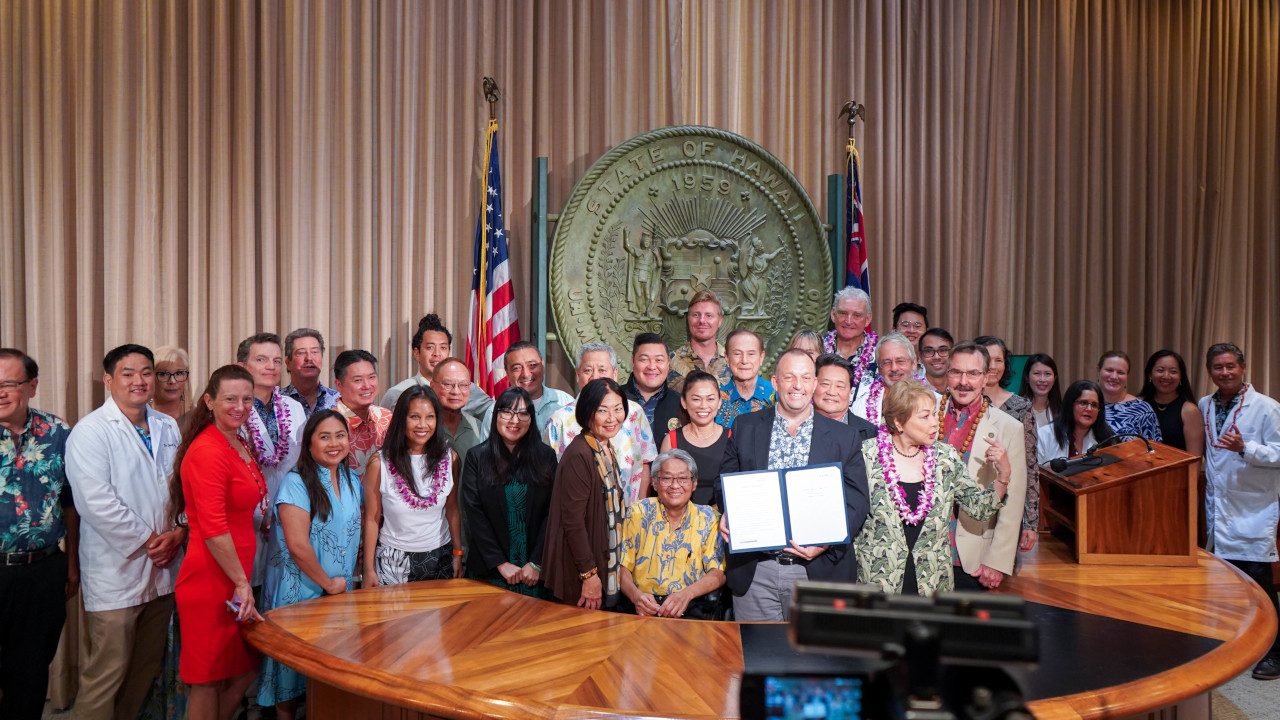

Governor Josh Green signed House Bill 2404 and Senate Bill 1035 into law during a ceremony at the Capitol, surrounded by supportive state lawmakers and advocates.

From the Office of the Governor:

HB 2404 amends two key components of Hawai‘i’s tax code over a seven-year period. In odd years, the legislation increases the standard deduction, which benefits low- and medium-income households. In even years, the legislation amends the tax brackets by eliminating the lowest brackets and lowering the tax rates for all brackets. As a result of these changes, the state income taxes paid by working class families will fall by 71 percent by 2031.

For example, a family of four making the median household income of $88,000 will see its take-home pay increase by $3,613 by 2031. Under current tax law, this family would owe $5,086 in state taxes. After implementing the tax law changes, the family would owe $1,479. A take-home pay calculator built by the Hawaiʻi Department of Taxation to determine income tax reduction impacts for both individuals and their families under HB 2404 can be downloaded here.

“This legislation is a historic step toward addressing the financial challenges and the cost-of-living crisis faced by Hawaiʻi’s working families,” said Governor Green. “By doubling the standard deduction and amending the tax brackets, HB 2404 provides much-needed tax relief to our residents.”

The changes to the income tax law reduce the tax liability of lower-income taxpayers more than higher-income taxpayers, increasing the tax system’s progressivity. Many taxpayers will now see their income tax liabilities transform into tax refunds from the state due to targeted income-based tax credits.

The legislation will help Hawai‘i transition from being the second highest-taxed state for working families to the fourth-lowest.

In addition to the historic tax reform, Governor Green also signed into law SB 1035, which exempts certain medical services from the GET. This legislation will provide relief to the healthcare system in Hawaiʻi by specifically exempting hospitals, infirmaries, medical clinics, health care facilities, pharmacies, and medical and dental providers from the GET on goods or services that are reimbursed through Medicaid, Medicare, or TRICARE.

“This law is a significant step toward relieving financial burdens and stimulating economic growth in our healthcare sector,” said Governor Green. “By exempting healthcare and dental services reimbursed from these critical programs from the GET, we will promote increased equity and access to healthcare and strengthen our healthcare infrastructure. As a former ER physician working in a rural community, I can confidently say that this legislation will be especially beneficial for rural healthcare providers and patients.”

SB 1035 received endorsement from more than 155 healthcare professionals and is seen as a potential solution to the state’s shortage of nearly 800 physicians. A recent survey of physicians by the John A. Burns School of Medicine found that elimination of the GET on medical services could be an effective means of recruiting and maintaining more physicians. “SB 1035 is a testament to our commitment to improving healthcare access and quality in Hawaiʻi,” said Governor Green.

“Hawaii taxpayers have long been subject to some of the highest taxes in the country,” said Keli‘i Akina, Grassroot president and CEO, in a written statement. Akina was in attendance for Monday’s bill signing. “For too long, our family and friends have been leaving our beloved islands because of our high cost of living, so I commend the Legislature and Gov. Green for working together to provide what has been rightly called historic tax relief that will lower Hawaii’s high cost of living, generate economic growth and help counter the exodus of Hawaii residents to the mainland,” Akina said.

“It’s incredible that Hawaii residents in the lowest tier of earners will go from having the second-highest state income-tax burden in the nation to the lowest, and average working families will see their state income tax burden drop from second highest to the third lowest,” Akina said. “The impacts of this brave move approved unanimously by our state leaders will be enormous.”

by Big Island Video News6:39 pm

on at

STORY SUMMARY

HONOLULU - The Governor also signed a bill that exempts medical services reimbursed by Medicare, Medicaid, and TRICARE from the state’s General Excise Tax.