(BIVN) – The Hawaiʻi economy will continue to grow, but at a slower pace than it did during post-pandemic years, according to a new forecast by UHERO, the University of Hawaiʻi Economic Research Organization.

“Maui rebuilding and the incremental return of international travelers will support tourism, helping to offset a moderate pullback in the continental U.S. market,” a UH news release stated, summarizing the new report. “Construction will continue to be a source of strength, even as overall job and income growth decelerate. Reducing inflation in the islands will take a bit longer than expected, and growth prospects for Hawaiʻi’s counties differ.”

A video on the 2024 second quarter forecast was produced by UHERO.

UHERO Focus: 2024 Q2 Forecast via YouTube

“The Big Island has seen the most population growth,” UHERO Executive Director Carl Bonham said in the video. “Oʻahu has been losing population for several years now, and our forecast is for that to continue to be very very stagnant. Our forecast for Maui is a 3,000 or 4,000-person loss of population between 2023 and 2024, and a very slow recovery.”

“And it shouldn’t be a surprise that the county with the most population growth is also the county that’s added the most housing units, and has sort of the most affordable housing situation of any of the other counties,” Bonham added. “So this very anemic population growth and slow labor force growth is going to act as a constraint on overall economic growth.”

The full report can be found at the UHERO website.

UHERO – which is housed at UH Mānoa’s College of Social Sciences – offered these “key takeaways” from the May 10 report:

- The U.S. has continued to outperform its peers, supported by immigration and strong consumer spending. Some moderation of U.S. growth will occur as the labor force softens and high short-term financing costs weigh on households. But considering the economy’s impressive resilience, the extent of slowing will be less than previously anticipated.

- Other major visitor markets have struggled. The four counties have experienced somewhat differing visitor industry performance. All were affected by a first-half 2023 tapering of U.S. arrivals, which may have reflected waning post pandemic rebound travel. Maui has had a somewhat stronger than expected initial industry rebound, but faces a long road ahead. Other counties benefited from visitors substituting alternative Hawaiʻi destinations.

- Despite challenges, inflation-adjusted statewide visitor spending rose last year, propelled by the strongest daily per person visitor spending in more than three decades. Room rates held steady after a period of substantial gains, while there was substitution away from the luxury hotel segment. Inflation-adjusted visitor spending will decline a bit this year, before stabilizing in 2025.

- The state government budget is taking a smaller hit from Maui wildfire cost than expected, but pending hazard pay for employees who worked during COVID-19 will be an added state and county outlay. Already, recent years’ population decline has reduced revenue. The state legislature has passed the most ambitious tax cut and reform package in many years.

- Inflation has picked up in the islands, and it now exceeds the national average. This is primarily because of a delayed pass-through of higher rents. Inflation will resume its downward path over the next two years.

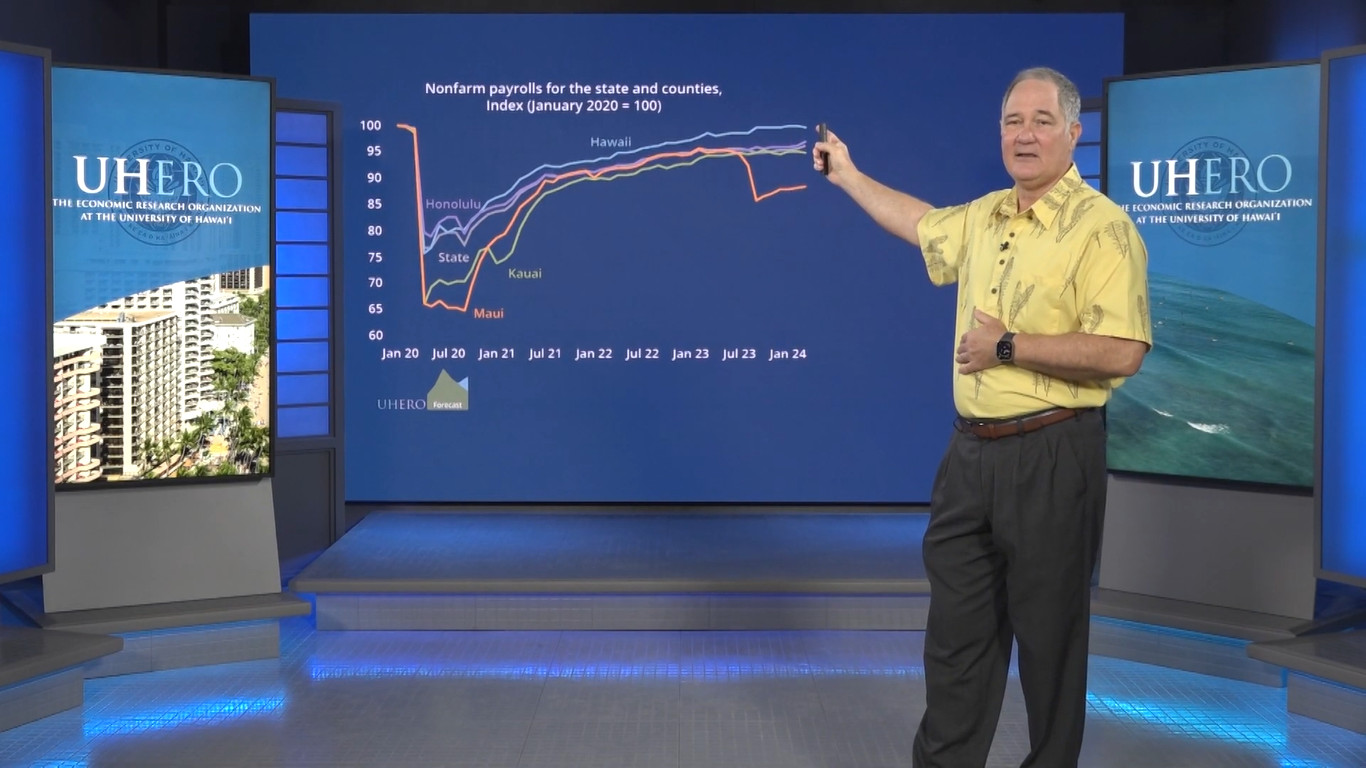

- Job growth continues at a modest pace in all counties other than Maui. Progress to house residents displaced by the Maui wildfires has been slow. A new law grants Maui and t he other counties more authority to regulate or eliminate short term rentals.

- Across all counties, soaring mortgage rates caused a dramatic drop in existing home sales, but overall construction activity remains buoyant. Maui rebuilding and ongoing private and government projects, especially on Oʻahu, will push construction employment to record highs.

- A significant new concern is the unfolding insurance crisis. The cost of condo insurance has soared nationwide because of more frequent catastrophic events. Most lenders will not issue new mortgages on under-insured properties. The state legislature has considered a public insurance pool to address these concerns, but this was not adopted during the recent term.

- Wage increases and declining inflation have raised real personal income, but it will slow below 1% this year. Real gross domestic product, our broadest measure of economic activity, will slow sharply from 3.6% growth in 2023 to 1.5% this year, but it will pick up in 2025 as Maui construction kicks into higher gear and external economies improve. As labor force and employment growth slow, both income and GDP will trend lower than in the past.

by Big Island Video News6:58 am

on at

STORY SUMMARY

HAWAIʻI - Hawaiʻi County population growth is outpacing other counties. Population growth is a factor that is linked to economic growth.