(BIVN) – This week, the Hawaiʻi County Council will hold a Special Finance Committee Meeting to examine the proposed County budget and conduct departmental reviews.

The meeting will convene at the Hilo Council Chamber starting on April 9th, 2024, at 9 a.m. HST. The meeting is scheduled to continue on April 10th and April 11th.

Here is the letter from Mayor Mitch Roth to the Hawaiʻi County Council, dated March 1, 2024:

Aloha Council Members:

As required by the Hawaiʻi County Charter, submitted with this message is the proposed operating budget for the County of Hawaiʻi for the fiscal year ending June 30, 2025. This balanced budget includes estimated revenues and appropriations of $888,082,546 and consists of the operations of the County’s thirteen special funds and the General Fund. This proposed FY 2024-25 budget is $54,675,923 or 6.6 percent greater than the FY 2023-24 budget.

REVENUE HIGHLIGHTS

Revenue is projected to increase across almost all revenue sources including real property tax, GET surcharge, and the Hawaii County transient accommodations tax. These revenue estimates were made with the information we have available at this time. As we approach May, these estimates will be reassessed and, if necessary, refined.

EXPENDITURE HIGHLIGHTS

The increases in expenditures are primarily attributable to established collective bargaining agreements, anticipated increases in consumption of fuel and utility services, rising insurance premiums, and additional supplies and equipment necessary to support increasing demands for County services. Contracts for all collective bargaining units result in a $30.5 million increase to the budget for employees’ salaries and wages, and corresponding fringe benefits. Providing fair and adequate wages allows us to attract and retain a quality workforce.

This budget is focused on reinforcing existing County operations and augmenting our capacity to address our community’s needs. This budget provides personnel support necessary to address challenging operational needs, purchases of new equipment and replacement of older equipment, and contractual services to ensure departments have the resources needed to provide the level of service our community deserves. This budget also expands funding to repair and improve our well-used and valued parks and recreation facilities, increases support for the expansion of our fire department’s critical fleet of emergency response vehicles, strengthens our information technology infrastructure and advances the incorporation of new software and technology in departmental operations to enhance efficiencies and capabilities.

Additionally, this budget includes $ 11.1 million in continuance of the County’s support for essential services to address the needs of our homeless population. It also provides $9 million for housing production, to continue the development of necessary housing inventory and related infrastructure to ensure our local families have housing options.

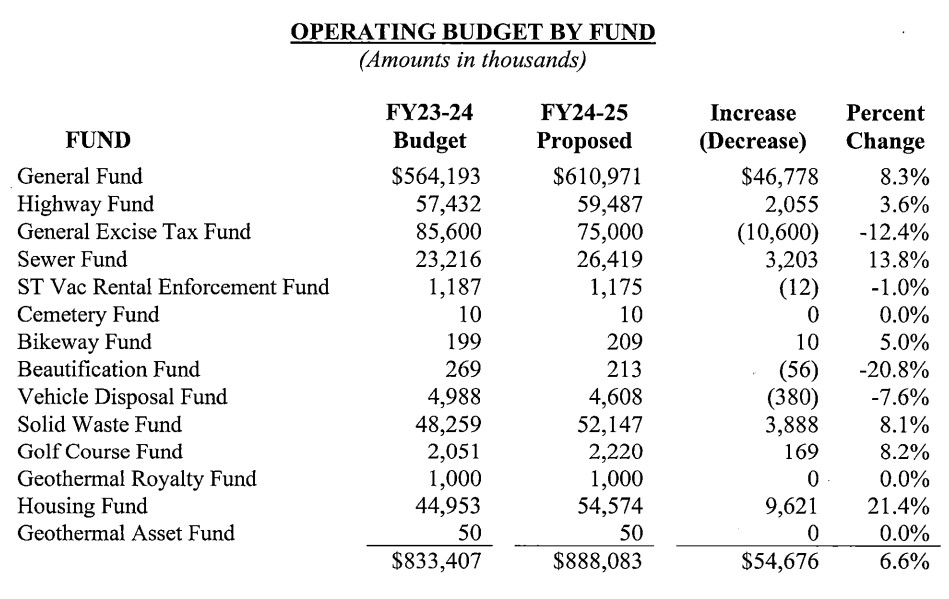

OPERATING BUDGET BY FUND

The following table describes the budgeted expenditures for FY 2023-24 and the proposed budget for FY 2024-25 for each fund:

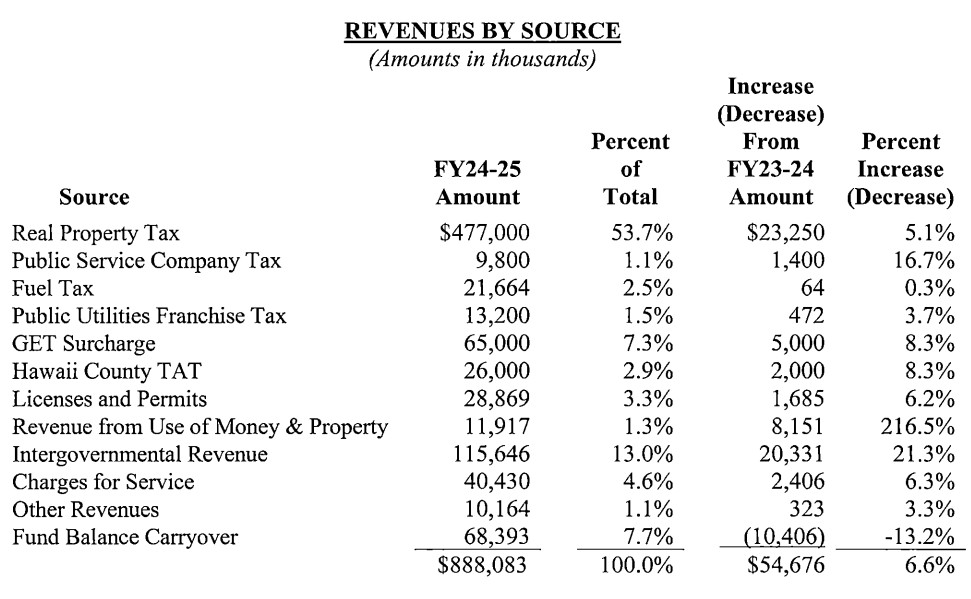

REVENUES BY SOURCE

The following table presents a summary of projected FY 2024- 25 revenues by source and their changes from the current FY 2023- 24 budget:

REVENUE CHANGES

The significant changes in projected revenues are as follows:

- Real Property Tax. Real property tax revenues are expected to increase by $23.3 million or 5.1% primarily due to an increase in taxable values and new construction.

- Public Service Company Tax. Public service company tax is expected to increase by $1.4 million or 16.7% in the coming year due to revenue increases for many of these taxpayers.

- GET Surcharge. GET surcharge revenues are expected to increase by $5.0 million or 8.3% based on current estimates.

- Hawaii County TAT. Hawaii County TAT is expected to increase by $2.0 million or 8.3% based on current estimates.

- Revenue from Use of Money & Property. Interest income is expected to increase by $8.2 million based on current economic conditions.

- Intergovernmental Revenue. Increases in grant revenues of about $20.3 million reflect those grants we are aware of currently.

- Fund Balance Carryover. This budget reflects $10.4 million less in carryover savings from the current year operations of all funds.

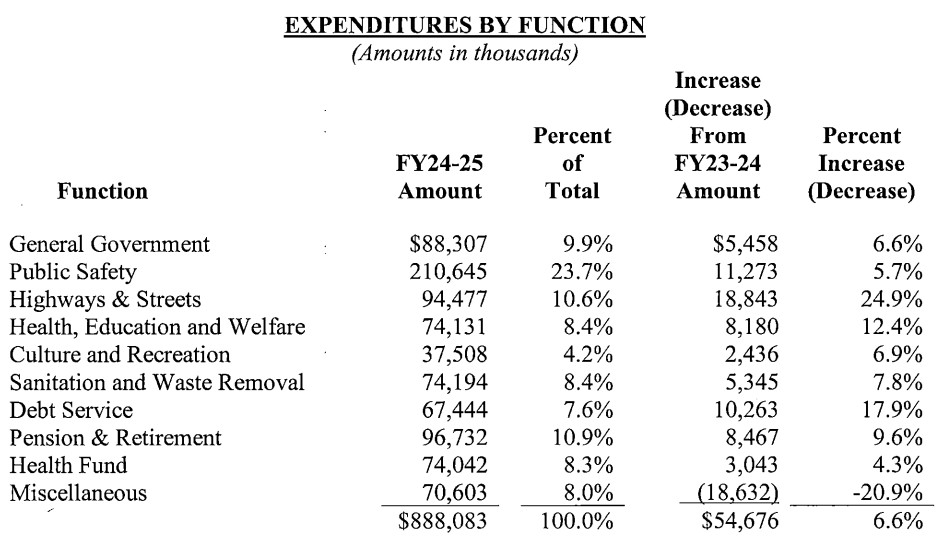

EXPENDITURES BY FUNCTION

The following table presents a summary of projected FY 2024-2025 expenditures by function and their changes from the current FY 2023-24 budget:

EXPENDITURE CHANGES

The increases in salaries and wages due to existing collective bargaining agreements are reflected in all functions of county government.

Other major changes in projected expenditures not explained above are as follows:

General Government

- Information Technology. New funding in the amount of $1.2 million is included to support advanced cybersecurity services for our IT networks and infrastructure. These services will assist in detecting and responding to cyber threats to our mission critical systems.

- Public Works. An increase of approximately $1.4 million is related to increasing premiums for property insurance, and funding for a new work order system and project management software to improve staff efficiency.

Public Safety

- Fire. An increase of $1.6 million is included to provide necessary response vehicles and equipment, facility repairs and personnel to address vehicle repair and maintenance.

- Animal Control and Protection Agency. An increase of $1.1 million is added to provide the agency with ten (10) vehicles for Animal Control Officers, a case management system, and additional shelter supplies and equipment necessary for the successful operation of the agency.

Highways & Streets

- Mass Transit. An increase of $8.4 million is attributable to expenditure increases in contracted services and equipment and an additional increase of $11.6 million in grant revenue and related grant expenditures for those grants we are aware of at this time.

Culture and Recreation

- Parks and Recreation. An increase of $1.0 million is included to address crucial park and recreation facility repairs. These repairs are critical to providing safe and functional parks and facilities to our community. These include beach parks, inland parks, zoo and equestrian center, municipal golf course, sports complexes, and playgrounds.

Debt Service

- Debt Service. The account was increased by $10.2 million to account for funding obligations related to critical infrastructure repair and enhancements including wastewater infrastructure.

Miscellaneous

- Transfer to Capital Project Fund. Transfer to Capital Projects Fund decreased by approximately $ 17.8 million in the General Excise Tax Fund due to a one-time transfer in the prior year.

CONCLUSION

We remain dedicated to investing in our future so that our keiki and their keiki will be able to thrive here for generations. That starts here, with us, by providing our employees adequate wages that allows for a better quality of life for them and their families. Further, these initiatives support policies that protect our environment, preserve our natural resources, and foster a robust and resilient community. From building affordable housing to making critical improvements to our roads, sewers, and parks, we have strived to create an adaptable economy that benefits all our residents. As we look towards the future, we remain committed to continuing this work and ensuring that Hawaii Island remains a place where our children and grandchildren can live, work, and thrive. With your help, we will build a brighter, more sustainable future for our cherished Hawaiʻi Island.

We look forward to working closely with the Hawaiʻi County Council as we prepare a responsible budget to meet the needs of our community.

by Big Island Video News8:51 pm

on at

STORY SUMMARY

HILO, Hawaiʻi - The Hawaii County Council will convene a special finance committee meeting in order to conduct its annual departmental budget review.