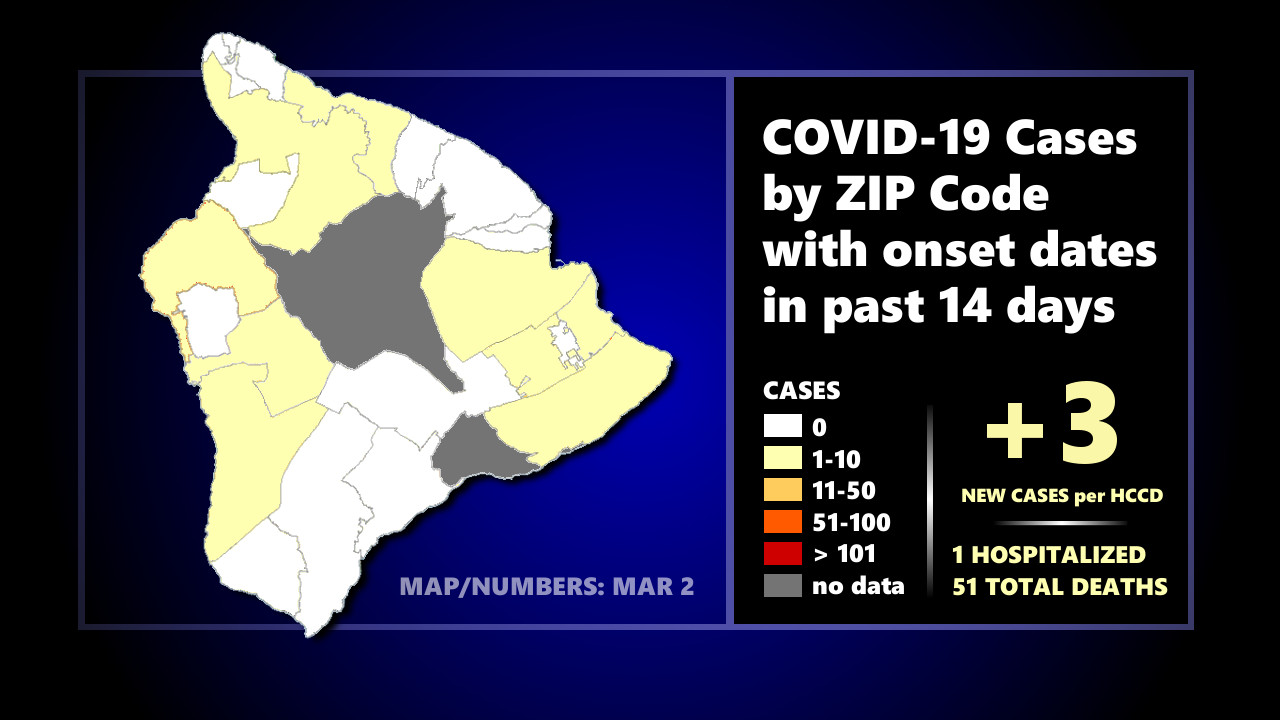

(BIVN) – There were 35 newly reported cases of COVID-19 in the State of Hawaiʻi on Tuesday. Of that number, three (3) case were identified on the Big Island.

The Hawaiʻi Department of Health says there have been 33 cases of COVID-19 reported on Hawaiʻi island in the past 14 days.

Hawaiʻi County has seen an average 0.4% test positivity rate over the last 14 days, with an average of only two new cases per day.

From the Hawaiʻi County Civil Defense:

The Hawaii Department of Health reports three (3) new case of Coronavirus with one (1) person hospitalized on Hawaii Island. There have been no deaths reported in the last nine weeks.

While new case numbers remain low, the risk of infection remains. Remember the importance of following the preventative policies of wearing face masks, maintaining distance, and limiting gatherings to no more than 10 persons. Thank you for your patience with the vaccination process as you wait for your opportunity to be vaccinated. Everyone will have an opportunity as production increases and more supplies become available. Mahalo for your kokua.

The Department of Health continues to coordinate vaccination points of distribution around the Island. Medical facilities and pharmacies on Hawaii Island are offering vaccine registration to individuals who are 75 and older. For a list of all the facilities providing vaccinations visit the Civil Defense website.

The Hawaiʻi Department of Health reports there has been 362,033 cumulative doses of COVID-19 vaccine administered in the State of Hawaiʻi, an increase of 5,190 from the previous day.

Governor Signs Bill Lowering Employer Contribution Tax Rate

Hawaiʻi Governor David Ige signed HB 1278 HD1 Relating to Employment Security into law as Act 1 on Tuesday, setting the employer contribution tax rate at a lower level with Schedule D for 2021 and 2022.

The governor says he signed the measure “in response to the unprecedented increase in Hawaii’s unemployment rate due to the COVID-19 Pandemic.” Without intervention, he says, Schedule H (the highest tax rate) would have been in effect for 2021.

“Temporarily reducing unemployment insurance tax rates will help to contain the economic fallout from COVID-19 and expedite the state’s economic recovery. I signed HB 1278 to protect employers from higher tax rates at a time when they can least afford it.” said Gov. Ige.

According to the State, the measure allows employers to pay, on average, less than half of what they would otherwise pay into the system. The State added:

- In 2021, the average Schedule H tax on employers would have been $1,800 per employee, per year. Act 1 reduces the average tax to $850– for a savings of $950 per employee per year.

- In 2022, the average tax would have been $1,670 per employee, per year. Act 1 reduces the average tax to $790 – for a savings of $880 per employee, per year.

“I’d like to thank the Legislature for fast-tracking this measure, so the DLIR can implement the changes swiftly. This is another example of how the legislative and executive branches can work together to boost the state’s economic recovery,” the Governor said in a news release.

The State added:

The Unemployment Compensation Trust Fund (UCTF) had a reserve of $607.5 million as of November 2019. The UCTF balance was depleted in June 2020 due to the extraordinary unemployment rate caused by the disruptions of the COVID-19 pandemic. The unemployment rate skyrocketed from 2.3% in March to 23.6% in April, because of measures taken to contain the state’s initial COVID-19 outbreak.

“The law allows the department to omit benefit charges for employers in their annual rate calculation due to the event of COVID-19 in calendar years 2021 and 2022 and authorizes the DLIR to provide relief for certain non-profit employers,” said DLIR Director Anne Perreira-Eustaquio. “Omitting the benefits charged to all contributory employers in 2021 and 2022 will result in a significant decrease in employer contributions.”

Setting the tax rate schedule at D will mean that all contributory employers will share in the replenishment of the UCTF and help re-establish the fund’s integrity. Schedule D’s tax rates are .2% to 5.8% while Schedule H’s rates begin at 2.4% to 6.6%.

by Big Island Video News10:18 pm

on at

STORY SUMMARY

HAWAIʻI ISLAND - As Hawaiʻi tallied another relatively low case count on Tuesday, Governor Ige signed a bill lowering the employer contribution tax rate for two years.