Administration Says Proposed Budget Will Not Raise Property Taxes

BUDGET NOTES

- The proposed FY 2015-2016 budget is $17,752,059 or 4.3 percent larger than last year’s budget.

- There will be no property tax increase for Hawaii County, if the budget is approved.

- Real property tax values are expected to increase by 3.2%, or $7.4 million, due to new construction and an increase in taxable values.

FULL TEXT OF MAYOR’S BUDGET MESSAGE – February 27, 2015

Aloha Council Members:

As required by the Hawai‘i County Charter, submitted with this message is the proposed operating budget for the County of Hawai‘i for the fiscal year ending June 30, 2016. This balanced budget includes estimated revenues and appropriations of $434,667,890 and includes the operations of eleven of the county’s special funds as well as the general fund.

This fiscal year (FY) 2015-2016 proposed balanced budget is $17,752,059 or 4.3 percent larger than last year’s budget. Our administration has always worked hard to provide public safety, core county services, and much needed investments in infrastructure while working through the realities of the economic climate created by the great recession. This budget reflects our commitment to maintaining the highest level of government services by wisely using county resources to meet the community’s needs.

This budget will not raise property tax rates.

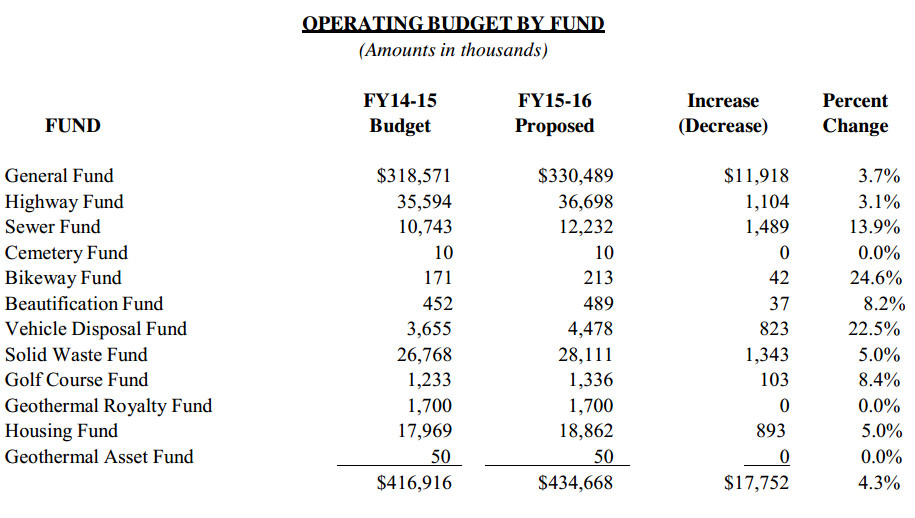

OPERATING BUDGET BY FUND

The following table describes the budgeted expenditures for FY 2014-15 and the proposed budget for FY 2015-16 for each fund:

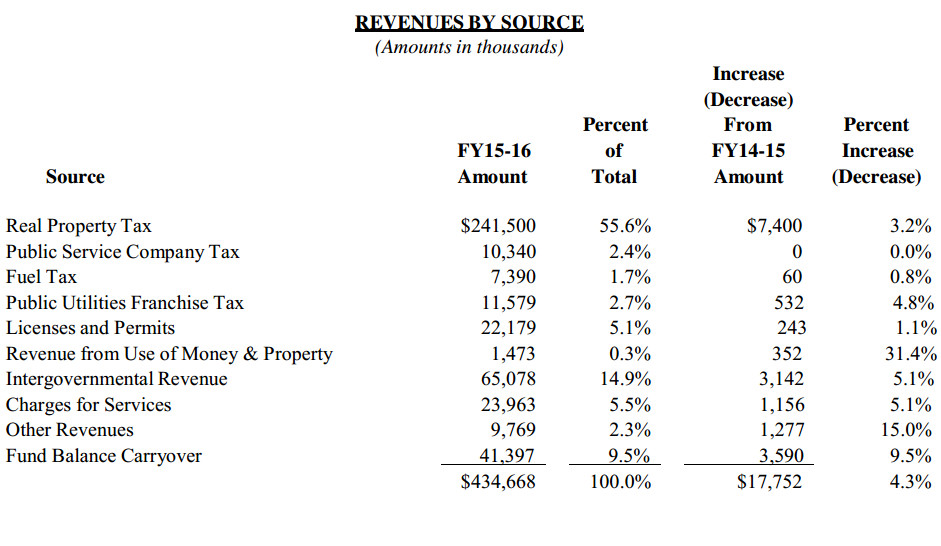

REVENUES BY SOURCE

The following table presents a summary of projected FY 2015-16 revenues from various sources and the changes from the current budget:

REVENUE CHANGES

The major changes in projected revenues are as follows:

Real Property Tax. Real property tax revenues, including penalties and interest, are expected to increase by 3.2%, or $7.4 million, due to new construction and an increase in taxable values.

Public Utilities Franchise Tax. Increased public utility revenues are expected to result in an increase of $532,000, an increase of 4.8% in franchise tax revenue.

Intergovernmental Revenue. Increased grant revenues of $3.1 million reflect those grants we are aware of at this time.

Charges for Services. Charges for services are expected to increase $1.2 million and reflect the increase in usage of various County services.

Other Revenues. Increased other revenues of $1.3 million includes increases in real property tax sales and program income.

Fund Balance Carryover. This budget reflects $3.6 million more in carryover savings from the current year operations for all funds.

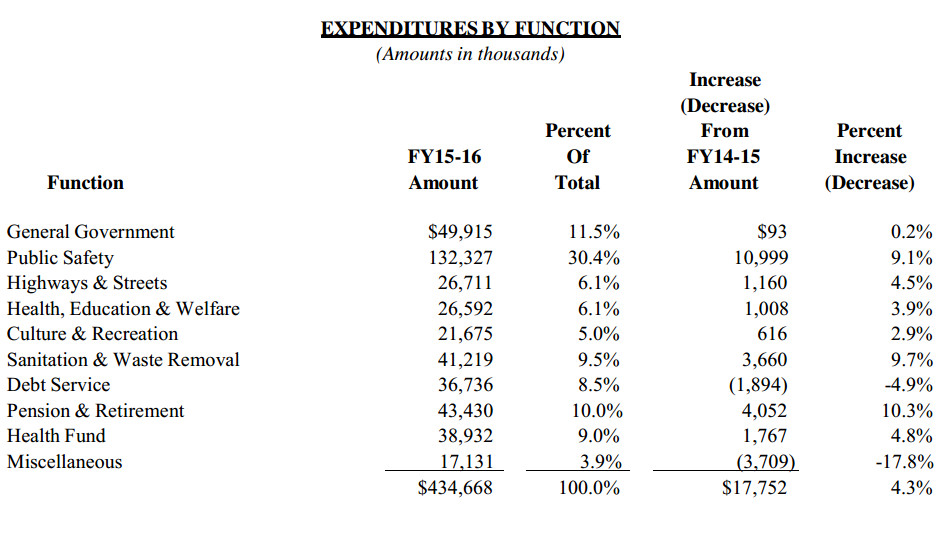

EXPENDITURES BY FUNCTION

The following table presents a summary of projected FY 2015-16 expenditures from various sources and the changes from the current budget:

EXPENDITURE CHANGES

Increases in salary and wages are reflected in all functional areas of county government. After several years of furloughs or no wage increases, new wages were negotiated for all bargaining units represented in the county. All salary and wages are reported in each department with the exception of the few bargaining units with contracts that end on June 30, 2015. The new contracts will need to be approved by the legislature and each County and are estimated in the provision for compensation adjustment account.

Major changes in projected expenditures are as follows:

General Government

- Public Works. Appropriations decreased by approximately $685,000, primarily due to expected savings in fuel.

- These savings were offset by the increases to salary and wages explained above.

Public Safety

- Police. Police received $1.8 million in additional grant funding.

- The majority of other changes in public safety are attributable to salary and wage increases explained above.

Highways & Streets

- Mass Transit Agency. Increased appropriations of approximately $1.0 million are primarily attributable to an increase in the paratransit program as mandated by the Federal Transit Administration.

Health, Education & Welfare

- Aging. Increased appropriations of $248,000 are due to additional grant funding for the Area Plan on Aging.

- Housing. Increase appropriations of $900,000 are primarily due to additional grant funding of $615,000 for housing subsidies.

Sanitation & Waste Removal

- Wastewater Fund. An increased appropriation of approximately $1.2 million is related to additional expenditures required for the Hilo Outfall as well as other aging plant and equipment.

- Vehicle Disposal Fund. An increased appropriation of approximately $800,000 will provide additional funding for environmental cleanup.

- Solid Waste Fund. The appropriations for organic waste and equipment repairs and maintenance increased by about $800,000 because of increased costs.

Debt Service

- Transfer to Debt Service. As the result of previously refinancing old bond issues, there is a reduction in debt service cost of $1.9 million for the upcoming year.

Pension & Retirement

- Retirement Benefits. Contributions to the employee retirement system will increase by approximately $4.1 million as the result of new salary and wage costs and rate increases established by the state legislature.

Health Fund

- Health Benefits. Contributions to the state employee health system will increase by $1.8 million, which includes an increase of $1.2 million for future post-employment health benefits.

Miscellaneous

- Provision for Compensation Adjustment. This provision contains the estimated cost of salary and wages pursuant to contract negotiations that have not been fully approved, and decreased by about $3.8 million. The $2.0 million appropriation is related to pending negotiations for Bargaining Units 2, 3 and 4.

Conclusion

This proposed budget represents our departments’ best efforts to meet the needs of our growing community in a timely and fiscally responsible fashion. Our administration is committed to investing in our future, maintaining core services and meeting our obligations to our employees.

Our economy is in a state of gradual recovery. We believe our investments in infrastructure, renewable energy, and parks and recreation are critical to the future of Hawai’i Island. We look forward to working closely with the County Council to put forth a balanced budget that ensures public safety and meets the needs of our community.

Mayor William P. Kenoi

by Big Island Video News12:49 am

on at

STORY SUMMARY

The proposed budget is $17,752,059 or 4.3 percent larger than last year's spending plan, with no increase in property taxes.