(BIVN) – Hawai‘i County Mayor Harry Kim has signed a Third Supplementary Emergency Proclamation due to the ongoing eruption of Kilauea Volcano. The proclamation suspends sections of Chapter 19 the County Code dealing with Real Property Taxes.

The Third Supplementary Emergency Proclamation reads:

WHEREAS, Chapter 127A Hawai‘i Revised Statutes, provides for the establishment of County organizations for emergency management and disaster relief with the Mayor having direct responsibility and authority over emergency management within the County;

WHEREAS, Chapter 127A Hawai‘i Revised Statutes and Chapter 7, Articles 1 and 2 of the Hawai‘i County Code, establishes a Civil Defense Agency within the County of Hawai‘i and prescribes its powers, duties, and responsibilities, and Section 13-23 of the Hawai‘i County Charter empowers the Mayor of the County to declare emergencies; and

WHEREAS, on May 3, 2018, the Mayor of the County of Hawai‘i and the Governor of the State of Hawai‘i issued respective Emergency Proclamations declaring states of emergency due to active lava erupting along the East Rift Zone in Lower Puna, County and State of Hawai‘i; and

WHEREAS, on May 9, 2018, the Governor of the State of Hawai‘i issued a Supplementary Proclamation expanding the scope and application of his Proclamation in order to provide further emergency disaster relief by suspending additional sections of the Hawai‘i Revised Statutes; and

WHEREAS, on May 22, 2018, the Mayor of the County of Hawai‘i issued a Supplementary Emergency Proclamation suspending Hawai‘i County Code, Chapter 19, Section 19-47, related to real property tax assessments to those parcels that suffered uninhabitability or isolation due to this eruptive event in those areas described as Leilani Estates, Lanipuna Gardens, Pohoiki Bay Estates and Kapoho Estates; and

WHEREAS, on May 30, 2018, the Mayor of the County of Hawai‘i issued a Second Supplementary Emergency Proclamation suspending several County Code provisions related to the preparation, set-up, construction, or installation of temporary emergency shelters for residents displaced or voluntarily evacuated due the active lava eruption; and

WHEREAS, on May 30, 2018, the Mayor of the County of Hawai‘i issued Mayor’s Emergency Rule #1 restricting access to the area containing Kapoho Beach Lots, Vacationland and Kapoho Farm Lots; and

WHEREAS, on May 31, 2018, the Mayor of the County of Hawai‘i issued a Mandatory Evacuation Order for identified areas within the Leilani Estates subdivision; and

WHEREAS, the United States Geological Survey (USGS) Hawai‘i Volcano Observatory (HVO), cannot project an end date to this eruptive event and has noted that previous eruptive events in the area have lasted for several months; and

WHEREAS, as of this date, the eruption has inundated over 6,000 acres of land and destroyed over 600 structures; and

WHEREAS, due to the ongoing eruption’s increasing areas of inundation, I have determined that it is necessary to supplement and expand my May 22, 2018 Supplementary Emergency Proclamation related to real property tax assessments in those areas described as Leilani Estates, Lanipuna Gardens, Pohoiki Bay Estates and Kapoho Estates to include a larger area; and

WHEREAS, Section 127A-13(b)(1), Hawai‘i Revised Statutes, provides that during the emergency period, the Mayor may “[r]elieve hardship and inequities, or obstruction to public health, safety, or welfare, found by the mayor to exist in the laws of the county and to result from the operation of federal programs or measures taken under this chapter, by suspending the county laws in whole or in part, or by alleviating the provisions of county laws on such terms and conditions as the Mayor may impose…”; and

WHEREAS, Section 19-68 (a)(3), Hawai‘i County Code, states that homeowners’ exemptions are to be applied at least one-half year after the approval of that exemption; and

WHEREAS, I find that homeowners that are able to relocate from the affected area not being able to have their homeowner’s exemption relocate with them until one-half year later places an unnecessary hardship and inequity upon them; and

WHEREAS, to relieve hardship and inequity, for those persons who have relocated from the affected area due to uninhabitability or isolation to a new property which they intend to own and occupy as a principal home or residence, the period for claiming and applying a home owner exemption must be suspended; and

NOW, THEREFORE, I, Harry Kim, Mayor of the County of Hawai‘i, do hereby proclaim and declare that a state of emergency exists due to threat of imminent disaster on the Hawai‘i Island, effective 07:30., July 2, 2018, and continuing thereon for 60 days or until further act by this office.

I FURTHER ORDER, that pursuant to Section 127A-13(b)(1) Hawai’i Revised Statutes, the following sections of the Hawai’i County Code be suspended:

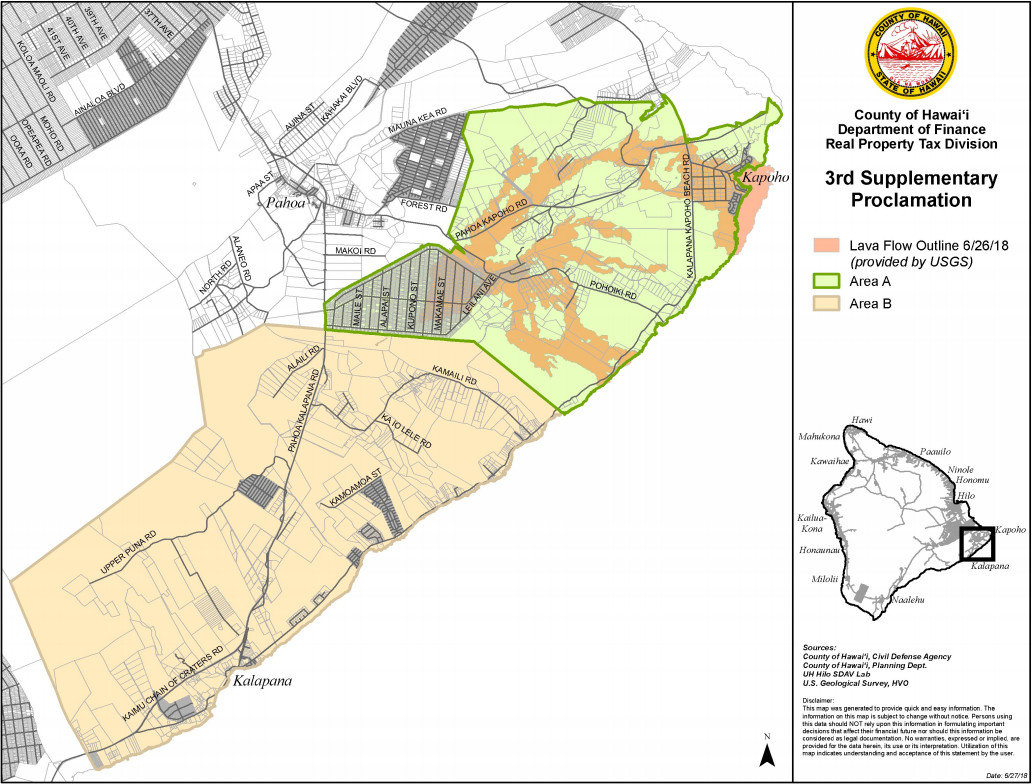

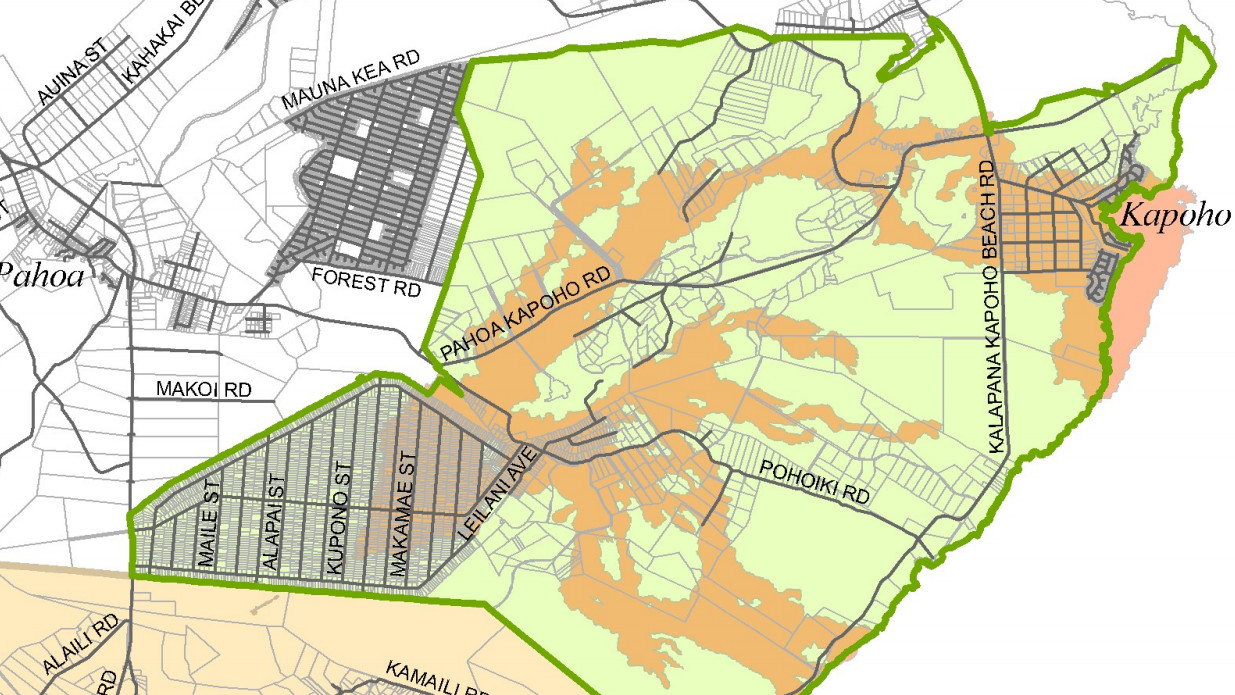

Chapter 19, Section 19-47 as it applies to those parcels that suffered uninhabitability or isolation or potential uninhabitability or isolation due to this eruptive event described as and further described and detailed on Exhibit “A” attached; and

Chapter 19 Section 19-68(a)(3) as it applies to those who had homeowner’s exemptions pursuant to section 19-68 in the area described as Leilani Estates, Lanipuna Garden, Pohoiki Bay Estates, Kapoho Estates, _____and further described and detailed on Exhibit “A” attached.

IN WITNESS WHEREOF, I have hereunto set my hand and caused the Seal of the County of Hawai‘i to be affixed. Done this 2nd day of July, 2018 in Hilo, Hawai‘i.

Harry Kim

Mayor

County of Hawai‘i

Exhibit A

The suspended Section 19-47 deals with the tax year, i.e. “time as of which levy and assessment made.” According to the Code, for real property tax purposes, “tax year” shall mean the fiscal year beginning July 1 of each calendar year and ending June 30 of the following calendar year. Real property shall be assessed, and taxes shall be levied thereon, as of January 1 preceding each tax year upon the basis of valuations determined in the manner and at the time provided in this chapter, the Code reads.

The suspended Section 19-68 (a)(3) dealing with claims for certain exemptions reads “the exemption from taxation granted for principal home in section 19-71 shall be allowed from the next tax payment date, provided that the claimant shall have filed a claim for the home exemption on or before December 31 for the first half payment or June 30 for the second half payment on such form as shall be prescribed by the department.”

by Big Island Video News3:17 pm

on at

STORY SUMMARY

PUNA, Hawaii - The proclamation provides relief for Puna parcels that suffered uninhabitability or isolation, or potential uninhabitability or isolation, due to the eruptive event.